Modern Mining Provides Corporate Update to E-Waste Processing

The Company aims to transform electronic trash into high value commodities

Modern Mining Technology Corp. is a “landfill-to-commodity” focused business venture, offering a cleaner, safer, and lower-cost commodity production alternative compared to traditional mining operations.

Our core business is aimed at processing and extracting strategic commodities from the vast, growing, and largely ignored global resource of electronic waste (“E-Waste”), and transforming these end-of-life landfill-bound materials into high-value resources. Value and strong economic potential is envisioned by using our proprietary aqueous based processes to recover, refine, and produce commodity metals such as: gold, palladium, silver, copper and potentially 30 other metals.

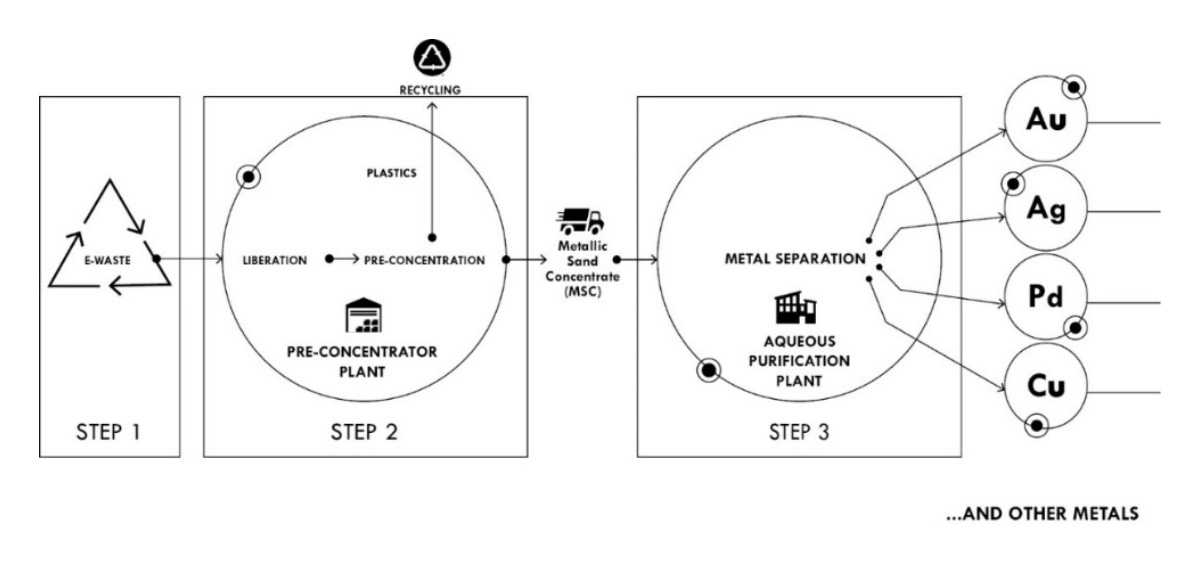

To achieve our objectives, we envision a three-step value-chain:

- We secure quality E-Waste feedstock from primary recycling partners;

- We separate the plastics from the metals using our proprietary pre-concentration methods. The plastics are then sold to downstream third-party recyclers and suppliers; and

- The concentrated metals streams are treated though our proprietary aqueous purification process, and the metal products are then sold into industrial supply chains.

Modern Mining’s business framework includes numerous key strategic advantages:

- High-grade Feed. Feedstock that delivers 100x better grades than traditional mined ores[1];

- Disruptive Technology. Proprietary aqueous based processing technology offers access to revenue through low carbon emissions and eco-friendly discharges, relative to the status-quo incineration methods in the industry[2];

- Growing Feed Supply. The world dumped a staggering 53.6 million tonnes (equivalent to the weight of over 250,000 jumbo jets) of E-Waste in 2019 alone, containing $57 Billion worth of high value recoverable metals, and this figure is growing (expected to reach 74 million tonnes by 2030)[3];

- Low-risk Value Chain. Unlike traditional mining, processing of E-Waste carries negligible exploration, geological, environmental, and geo-political risk because it is a man-made engineered product; and

- Low-capex Business Model. Less than 1/80th the capex of traditional gold mines[4].

Modern Mining elected to make North Carolina home as a logical extension of local research efforts, favorable incentives, proximity to major logistics networks, and direct access to some of the world’s largest supplies of electronic waste through proximity to the densely populated eastern seaboard.

Over the past year Modern Mining has continued to grow the business and has achieved several significant milestones:

Facility Highlights:

- Secured a new and larger facility in Greenville, North Carolina, to accommodate our process expansion plans;

- Purchased, installed, and energized pilot plant shredding, milling, conveying, and metal separation equipment to demonstrate our pre-concentration processes at-scale at our Greenville facility; and

- Remobilized and installed our pilot refining equipment in our Greenville facility to reduce costs and consolidate our operating presence.

Operational Highlights:

- Achieved positive results from bench scale pre-concentration test work to further strengthen our process understanding;

- Procured approximately 5,000 lbs. of E-Waste feedstock at our Greenville facility to support pilot plant start-up;

- Processed feedstock through our Greenville facility to support our pilot plant commissioning activities, with ramp-up in progress; and

- Generated metallic-sand-concentrates to facilitate product sales discussions with potential commodities buyers.

While global commodities prices remain volatile in the aftermath of post-pandemic demand, war in Ukraine, and recessionary concerns, the fact remains that efficient, clean, and cost-effective recovery of commodity metals from E-Waste is a largely untapped business sector that we believe is poised for breakthrough growth.

Modern Mining is strategically directed to capture value in the commodities space as we help empower the world’s transition towards a circular economy.

[1] See S&P Capital IQ data publicly available which reports grade and tonnage values for the reserves and resources of every active primary gold mine currently in production across the world up to the date May 25, 2022. The average gold grade of global reserves and resources is approximately 1.29 g/t Au. We anticipate the average grade of our feedstock to be approximately136 g/t Au, which represents a grade 100 times better than traditional mined ores like gold.

[2] See Value-Added Products From Thermochemical Treatments of Contained E-Waste Plastics, Das, Gabriel, Tay and Lee.

[3] See Global E-Waste Monitor 2020.

[4] See S&P Capital IQ data publicly available. The average capital expenditure for every primary gold project in North America between January 2021 and May 2022 is approximately $425 million. Our estimated capital expenditure costs are anticipated to be between $5 million and $5.5 million, yielding a figure of 1/80th the capital expenditure of traditional ore mines.